ROIC, or “return on invested capital”, represents the efficiency at which a company utilized its capital to work in order to generate profitable returns on behalf of its shareholders and debt lenders.įundamentally, the return on invested capital (ROIC) answers the question of, “How much in returns is the company earning per dollar of invested capital?” the company’s fixed assets and net working capital (NWC).

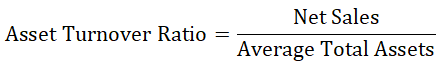

By the same token, real estate firms or construction businesses have large asset bases, meaning that they end up with a much lower asset turnover. For example, retail businesses tend to have small asset bases but much higher sales volumes, so they’re likely to have a much higher asset turnover ratio. It’s important to note that asset turnover ratio can vary widely between different industries. A lower asset turnover ratio indicates that a company is not especially effective at using its assets to generate revenue. In short, it indicates that the company is productive and generates little waste, while it also demonstrates that your assets are still valuable and don’t need to be replaced. The higher your company’s asset turnover ratio, the more efficient it is at generating revenue from assets. Total Assets = Liabilities + Owner’s Equity What is a good total asset turnover ratio? Here’s the asset turnover rate formula that you can use in your calculations:

#Capital asset turnover formula how to

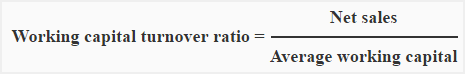

Want to know how to calculate total asset turnover ratio? It’s relatively simple. Typically, total asset turnover ratio is calculated on an annual basis, although if needed it can be calculated over a shorter or longer timeframe. It’s an excellent indicator of the efficiency with which a company can use assets to generate revenue. Asset turnover definitionĪsset turnover ratio is a type of efficiency ratio that measures the value of your business’s sales revenue relative to the value of your company’s assets. Check out our asset turnover definition and learn how to calculate total asset turnover ratio, right here. Total asset turnover ratio is a great way to measure your company’s ability to use assets to generate sales. But working capital doesn’t just include cash flow, it also includes all the assets that are available to cover operational expenses or business costs.

The success of your business relies on working capital.

0 kommentar(er)

0 kommentar(er)